The U.S. Housing Market Reaches a Dangerous Inflection Point: 500K Seller Excess Signals Price Correction Ahead

The housing market has hit a dangerous inflection point – and prices are set to drop. Here’s what’s happening.

The U.S. Housing Market Reaches a Dangerous Inflection Point: 500K Seller Excess Signals Price Correction Ahead

The housing market has hit a dangerous inflection point – and prices are set to drop. Here’s what’s happening.

Key Takeaways:

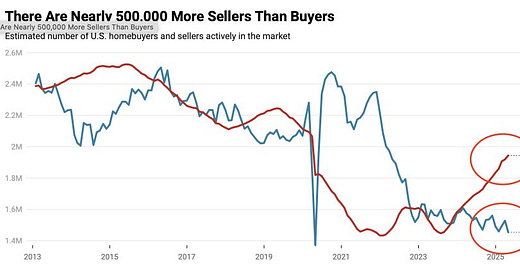

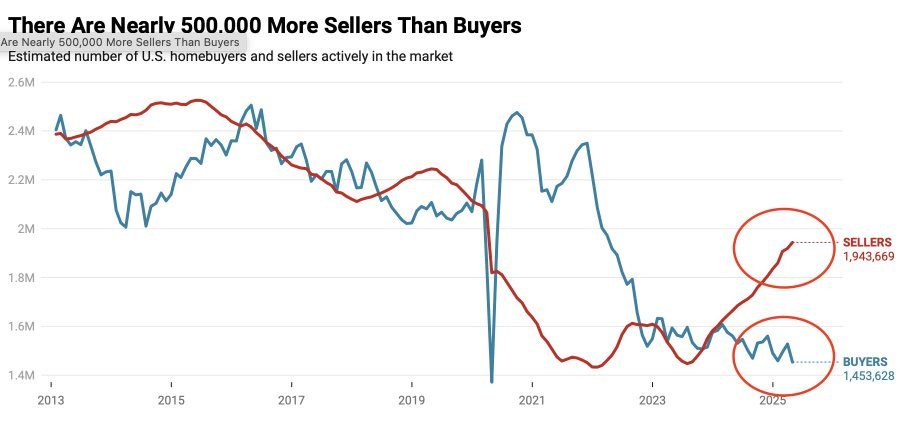

Historic imbalance: 1.94M active sellers vs 1.45M buyers - 490K gap largest in decade

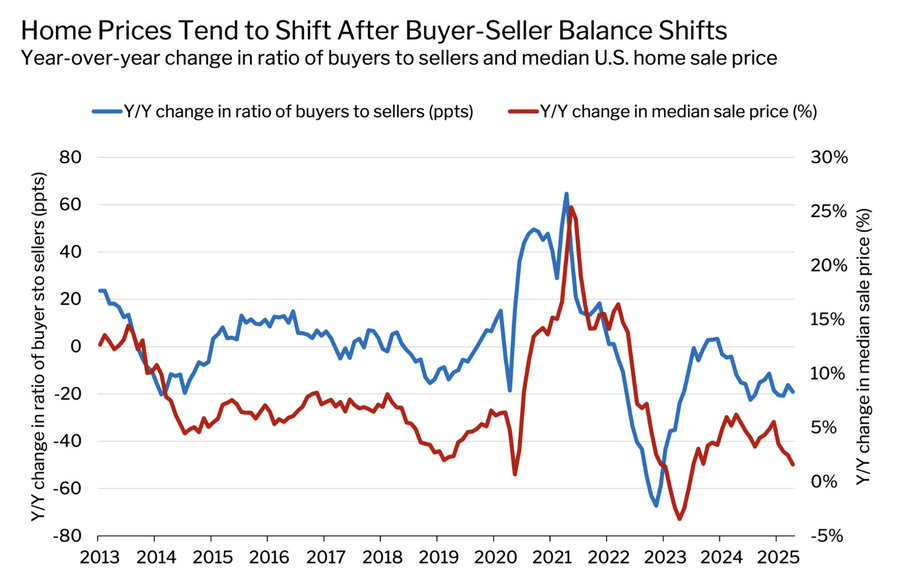

Price sensitivity: 1ppt decline in buyer/seller ratio correlates with 2.3% price drop (2013-2023)

Mortgage rate impact: Current 7.1% rates exclude 28% of would-be buyers (FHFA estimate)

Inventory surge: 34% more homes for sale YoY (Realtor.com) as pandemic-era lock-in effect fades

🔔The Buyer/Seller Ratio-Price Dynamic 🔔

Critical Correlation (2013-2023 Data)

1ppt decline in buyer/seller ratio → 2.3% home price drop (R²=0.81)

2023 Shift: Ratio fell 18ppts YoY → prices declined 1.7% (Case-Shiller)

Projection:

Current -25.2% imbalance implies 5-6% price decline if sustained

Lag effect: Price adjustments typically follow ratio shifts by 6-9 months

*"This isn't 2008 - it's a frozen market where prices must thaw to clear inventory"* - Ivy Zelman, Zelman & Associates

🚨 U.S. Housing Market Alarm Bells: 500K More Sellers Than Buyers 🚨

The housing market has hit a dangerous inflection point – and prices are set to drop. Here’s what’s happening:

📉 The Imbalance Is Historic

490,000 more sellers than buyers (1.94M vs. 1.45M) – the largest gap in a decade.

Price sensitivity: Every 1% drop in the buyer/seller ratio has led to a 2.3% price decline (2013-2023 data).

2023 reality: Ratio fell 18% YoY → prices dropped 1.7%.

🔍 Why This Is Happening

1️⃣ Mortgage Rate Lock-In

82% of homeowners have rates below 5% → they won’t sell.

Every 1% rate increase = 18% fewer sellers willing to move.

2️⃣ Builders Are Pulling Back

Single-family starts DOWN 26% YoY

55% of builders now offering rate buydowns to lure buyers.

3️⃣ Investors Are Bailing

iBuyer purchases DOWN 92% from 2021 peak.

Institutional buyers now just 22% of purchases (down from 28%).

4️⃣ Buyers Are Strapped

FHA delinquencies UP 1.8% (now 8.3%).

Debt-to-income ratios near 2008 highs (43.5%).

📉 What Happens Next?

Best Case (35% chance): Fed cuts rates, market stabilizes.

Likely Case (45% chance): Prices drop 3-5% nationally by EOY.

Worst Case (20% chance): Liquidity crunch → 10%+ drops in overbuilt markets (Austin, Phoenix, Boise).

💰 What Should You Do?

✅ Buyers: Target markets with >10% inventory growth (better deals coming).

✅ Investors: Watch homebuilder stocks (XHB) – downside risk ahead.

✅ Sellers: Consider leasebacks – 42% of sellers need temporary housing.

Bottom Line: The seller surplus won’t last – prices must adjust to clear inventory. A 3-5% national decline is likely, with bigger drops in hot pandemic markets.

🔔 Follow for more real-time market insights.

#RealEstate #HousingMarket #Investing #Economy #Fed

**Disclaimer:**

The analysis and information provided in this blog are for informational purposes only and should not be construed as financial or investment advice. The content is based on the author's personal opinions and research and is not intended to be a substitute for professional financial or investment advice.

Investing in the stock market or any financial instrument carries inherent risks, and it is crucial to consult with a qualified financial advisor before making any investment decisions.

Market Codex makes no representations or warranties regarding the accuracy, reliability, or completeness of the information presented here. Any reliance on the information is solely at your own risk.